ATHEX headed north yesterday for a fourth session in a row, in line with the European stock markets. In more detail, the General Index climbed by 0.63% to 1,471.26 units (FTSE Large Cap: +0.76%, FTSE Mid Cap: +0.03%, Banks Index: +0.55%) and the traded value was shaped at EUR 139.5m, up from Wednesday’s EUR 113.0m. We expect the market to try to digest recent gains today, with NBG and Avax in the spotlight.

Sector Headlines

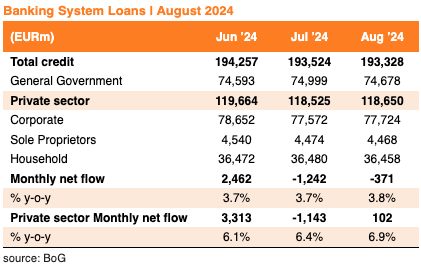

Facts: According to BoG, total credit to the economy (incl. the general government) came in at EUR ca193.3bn in August 2024 (+3.8% y-o-y, negative monthly net flow by EUR 371m), due to the negative monthly net flow of the general government by EUR 473m. Loans to the private sector increased by 6.9% y-o-y to EUR 118.7bn. NCE stood at EUR 1.65bn since the beginning of the year.

Comment: Net credit expansion turned slightly positive in August thanks to corporate loans that reached EUR 77.7bn (+11.3% y-o-y, positive monthly flow by EUR 159m). Loans to sole proprietors stood at EUR ca4.47bn (+0.4% y-o-y, negative monthly net flow by EUR 10m). Moreover, household lending was shaped at EUR 36.46bn (-0.7% y-o-y, negative monthly net flow by EUR 48m). Housing loans came in at EUR 27.34bn (-2.7% y-o-y, negative monthly net flow of EUR 64m). Consumer credit reached EUR 8.88bn (+5.8% y-o-y, positive monthly net flow of EUR 18m). Corporate loans accounted for 66% of private sector loans and household loans for 31%.

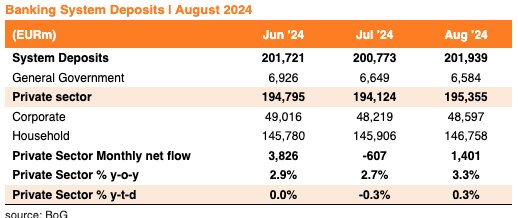

Facts: BoG announced that system deposits came in at EUR 201.9bn (+1.9% y-o-y, positive monthly net flow by EUR 1,337m) in August 2024. General Government deposits reached EUR 6.58bn (-27.2% y-o-y, negative monthly net flow by EUR 64m) and private sector deposits amounted to EUR ca195.4bn (+3.3% y-o-y, positive monthly net flow by EUR 1,401m). Corporate deposits came in at EUR 48.6bn (+5.4% y-o-y, positive monthly net flow by EUR 366m), whilst household deposits reached EUR 146.8bn (+2.6% y-o-y, positive monthly net flow by EUR 1,035m). Household deposits accounted for 75% of private sector deposits and corporate for the remaining 25%.

Comment: The monthly increase in private sector deposits (EUR 1,401m) in August is attributed primarily to household deposits (EUR 1,035m). Time deposits posted a positive monthly net flow by EUR 259m and accounted for 19.1% of private sector depos vs. 19.2% in July. Liquidity remains ample, with the LDR at 60.7% vs. 61.1% in July and the commercial surplus increased further to EUR 76.7bn from 75.6bn in July.

Company Headlines

Jumbo || BUY | CP: EUR 25.94 | TP: EUR 31.10

1H24 Results Review: Strong performance and profitability above our expectations

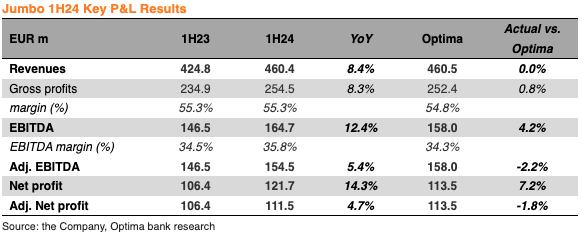

Jumbo released a strong set of results, with sales (already announced in early July) increased by +8.4% YoY, driven by growth in all countries that Jumbo operates, Greece (up by +7.0% YoY), Cyprus (up by +4% YoY), Bulgaria and Romania up by +11% YoY and by +14% YoY, respectively. Gross margin of the group remained at high despite inflationary pressures at 55.27% above our estimate of 54.8%. Regarding profitability, Jumbo’s EBITDA expanded to EUR 164,7m (up by 12.4% YoY and 4.2% above our estimates), and Net Profit jumped to EUR 121,7m, up by 14.3% YoY and up by 7.2% above our estimate. Note that Jumbo received EUR 10,21m insurance compensation for the Larissa and Karditsa stores that positively affected group EBITDA and Net profit.

Details: Turning to key balance sheet items, Jumbo’s net cash remained positive at EUR 351,4m, down by EUR 19,04m vs. FY23 despite the total dividend distributions of EUR 217.7m Management also reiterated its estimate for sales to growth by +4% in FY24 and that organic profitability will flirt with 2023 levels, affected by the unresolved global supply chain irregularities that increase transport costs and delivery times. Also, management stated that stocking and delivery policy have been adjusted to keep prices at levels in line with consumer income. Finally, management confirmed that by the end of 2024 two more hyper stores will be added to the network, one in Bucharest, Romania and one in Cyprus, while the second franchise store in Israel started its operations.

Comment: Jumbo, despite the headwinds from increased costs due to the tension in the Middle East, managed once again to quickly adjust its product mix, preserving both its operations as well as its profitability margins. In addition, Jumbo announced that the stores in Karditsa and Larissa restarted their operation while the addition of the new stores will lead to an easy comp 2H24 as Jumbo will operate with five more stores vs. 2H23. In our view, Jumbo is set to once again exceed its guidance as, a) has already announced an increase by 7% YoY sales increase in 8M24 b) due to the seasonality of Jumbo’s sales during the 2nd semester of the year with increased network. Finaly, Jumbo’s AGM approved a two – year share buyback programme of up to 10% of the company’s share capital with a price range from EUR 1.00 to EUR 27.00/share with cancellation option that in our view will further support the stock performance.

Conference call will be held today at 15.30 local time, Tel nos: Greek participants: +30 213 009 6000, UK participants: +44 (0) 203 059 5872, USA participants: +1 516 447 5632.

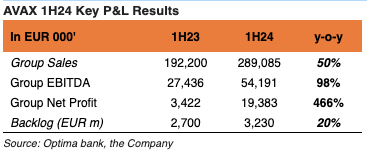

AVAX 1H24 Results-surprisingly strong results, driven by acceleration of construction and increased contribution from concessions; Backlog remains high at EUR 3.3bn

AVAX reported 1H24 turnover up by 50% y-o-y to EUR 289.1m, driven by construction which accounted for 95% of total, EBITDA from continuing operations at EUR 54.2m, 98% vs 1H23, on a EUR 25.8m/26.7m/2.3m Construction/Concessions/Others split with the construction EBITDA margin widening to 9.4% from 6.8% in 1H23) and Net Profit from continuing operations at EUR 19.4m, vs EUR 3.4m a year ago. Additionally, AVAX’ group Net Debt was flattish y-t-d at EUR 181.5m, despite increased WC needs of EUR 26.2m. Finally, despite the accelerated execution of various construction projects, AVAX maintained the Backlog close to record high of EUR 3.23bn (out of this total, private projects and PPPs account for 53%, with public projects contributing the balance of 47%, Greece accounts for 76% of the total, with international projects making up 24%).

Comment: AVAX recorded a very strong set of results, driven by the pick-up of the construction and the increased contribution from associates, mainly concessions, while at the same time maintained a very high Backlog, which secures further growth in the medium term. That said, and taking also into account that AVAX’ half year profitability challenges to the upside our full year estimates for 2024e (Optima FY24e EBITDA: EUR 62.9m, FY24e Net profits: EUR 27.8m), we reiterate our Buy recommendation for the stock with a EUR 2.79/share Target Price.

GEKTERNA 1H24 results out

GEKTERNA reported 1H24 group turnover of EUR 1,515.2m, down by 5.7% y-o-y (due to lower contribution from thermal generation and construction), EBITDA adjusted of EUR 269.1m, up by 7.6% y-o-y), with construction/concessions/RES/Energy segments contributing EUR 60.3m/77.8m/96.5m/46.9m respectively, while adjusted net profit stood at EUR 65.7m, up by 20.1% y-o-y and Net profit from continuous operations (i.e. excluding the held for sale Terna Energy) stood at EUR 54.9m from EUR 47m a year ago. Group backlog remained high at EUR 5.0bn, down by EUR 300m y-t-d, and there is due to increase further, as new project wins (North Crete) are not included in current backlog. Turning to leverage, group net debt stood at the 1H24 end at EUR 1,606m, up by EUR 10m y-t-d, while excluding the RES-related debt, stands at EUR 840m and close to zero when accounting the expected proceeds from the sale of TE. Finally, GEKTERNA reiterates the initial timeline for the completion of the TE deal, which was in 4-6 months since the 20th of June announcement.

Alpha Bank to announce new VES-Press

Press reports suggest that Alpha Bank will announce a new voluntary exit scheme of 300 employees. Recall that the group had 5,741 employees in Greece in 1H2024.

METLEN’s chairman and CEO comments (press)

The chairman and CEO of METLEN, Mr Mytilineos reportedly (Euro2day.gr) expressed his confidence yesterday that the company will double or even triple its size in the next 5 years.

Euroconsultants 1H24 results out

The company posted its results yesterday with revenues reached EUR 2.33m in 1H24, posting a 4% decrease y-o-y. EBITDA of the company stood at EUR 1.07m with the EBITDA margin remained high at 46%, while net profit of the group decreased by 24.8% y-o-y, to EUR 1.03m vs. EUR 1.37m in 1H23 mainly affected by the increased personnel cost. At the same time, there was further deleveraging, as total lease liabilities reduced to EUR 0.95m in 1H24 vs. EUR 1.04m in FY23, while also net cash position of the group remained robust at EUR 1.09m. Management also highlighted that all procedures for the sale of the office building in Thessaloniki have been completed and the estimated sale value is at EUR 5.1m. Finally, the company signed new contracts with total value of EUR 8.75m, that increased the total backlog to EUR 12.3m. In addition, projects amounting to EUR 5.0m have already been awarded and are expected to be signed in the coming weeks, while a further EUR 8.0m of submitted tenders are expected to be evaluated from which management expects to win a significant percentage.

The market ended yesterday’s session with 0.6% gains, on a EUR 139.5m turnover, with banks also up 0.5%, supported by Eurobank (+2.2%). Among top gainers, Aegean stood out recording a 3.7% increase, Titan rose c2.8%, Jumbo marked 2.5% gains, following strong 1H24 results and Motor Oil was up c1.8%. EYDAP and PPA finished with modest losses of -0.5%, while Terna Energy and Sarantis were flattish on the day.

MACRO – CORPORATE NEWS

BANKS

According to Bank of Greece, private sector lending growth in August accelerated further to 6.9% yoy (vs. 6.4% in July and 6.1% in June) with corporate loans advancing by 10.5% yoy (vs. 9.8% in July). On the deposit front, monthly inflows reached EUR 1.4bn with private sector deposits standing at EUR 195.4bn, up 3.3% yoy (L/D ratio of c.60%).

JUMBO <BELA GA, OW>

Jumbo reported a solid set of 1H124 numbers before the opening of the market. Preannounced sales stood at EUR 460m, demonstrating growth of +8% yoy (Greece +7%yoy, Cyprus +4%yoy, Bulgaria +11% yoy, Romania +14% yoy). Gross profit margin was retained at 55%, with reported EBITDA growth of 5.5% yoy at EUR 154m. On an adjusted basis for insurance claims related to compensation from two stores affected by September 2023 floods, EBITDA in 1H24 stood at EUR 164.7m, up 12.4% yoy. Similarly, reported net profit came in at EUR 111.5m, up 4.7% yoy, with adjusted figure of ERU 121.7m indicating yoy growth of 14.3%. Cash in hand as of June 2024 stood at EUR 351m from EUR 370m in the same period last year. EGM to approve today on a two year share buyback program of up to 10% of share capital with the acquired shares to be cancelled (price range EUR 1.0-27.2/share). On network rollout, the company reopened the two Greek stores that were closed due to floods, while it opened a new store in Oradea, Romania. Two more stores are scheduled to open by the end of the year, one in Bucharest and one in Cyprus. Current store network stands at 86 stores, of which 53 in Greece and 18 in Romania. Management is due to hold a conference call today, September 27th at 15:30 GR time. Dial ins: GR: +30 213 009 6000, UK: +44 (0) 203 059 5872, US: +1 516 447 5632.

GEK TERNA <GEKTERNA GA, OW>

GEK Terna announced 1H24 revenues of EUR 1.5bn, adjusted EBITDA of EUR 269m and net profits of EUR 65.7m. Continued operations (ex-Terna Energy) posted revenues of EUR 1.36bn (-9% yoy) with an adjusted EBITDA of EUR 172.6m (-3.2% yoy). The decline in revenue is due to the lower contribution from Conventional Energy (mainly on the back of lower prices) and a seasonal softness in construction (project timing with activity to pick up in the coming months). Adj. EBITDA margins improved in 1H24 driven by higher profitability in construction and the steady improvement in concessions (+5.7% yoy) due to strong traffic growth (+7.4% yoy). The group net debt from continued operations stood at EUR 840m in June and zero on a pro-forma basis post Terna Energy sale.

AVAX <AVAX GA>

The company reported strong 1H24 consolidated results from continuing operations, with revenues of EUR 289.1m, up 50.4% yoy, while group EBITDA recorded a 97.5% yoy increase, reaching EUR 54.2m. The increase in EBITDA was driven by strong performance in the segments of construction and concessions, amounting to EUR 25.8m (+111.5% yoy) and EUR 26.7m (+102.3% yoy) respectively. The group’s net profits reached EUR 19.4m compared to EUR 3.4m in 1H23, while net debt slightly decreased to EUR 213.5m vs EUR 221m in 1H23.

ATHENS WATER <EYDAP GA>

The company released its 1H24 results, with revenues rising 7.2% yoy, reaching EUR 174.5m, driven by high water consumption due to the high temperatures over the last few months. Group’s EBITDA amounted to EUR 30.2m, up 57% yoy, accompanied by a higher EBITDA margin of 17.3% compared to 11.8% in 1H23. Profit before taxes rose to EUR 14.5m, marking a 674% yoy increase, driven by lower financial expenses, while net profit totaled EUR 10m vs EUR 0.7m in 1H23.

Market comment // Trading in positive territory intraday, the Greek benchmark index closed at 1,471.3 points (+0.63%) yesterday, powered by the risk-on mood globally. Trade activity jumped to €139.5m, close to recently established levels and above the 100-day MA of €117m, with Banks representing c45% of traded value. Aegean and Kri-Kri set the pace for gainers rallying more than 3%, followed by Titan (+2.79%), Ellaktor (+2.55%), Jumbo (+2.53%) and Eurobank (+2.2%). Motor Oil, ADMIE and Motodynamics also booked gains >1%. On the negative side, ELHA (-1.2%), Optima Bank (-1.22%), Thrace Plastics (-1.03%), Dimand (-0.95%) and Papoutsanis (-0.86%) were among the few names holding the index back. The market is poised to maintain its upward momentum today, as risk-on sentiment remains intact following China’s policy easing and support measures, with investors also keeping an eye on the US PCE deflator data, due later in the day.

GEK Terna // Released half-year results reporting H1’24 revenue from continuing operations of €1.36bn (-8.9%), with EBITDA for the period settling at €173mn (-3.5% yoy) on tough comps for the conventional energy segment (-25.5% yoy). In bottom line, adj. net income from continuing operations settled at €54.9mn, marking a 16.8% growth yoy.

Terna Energy // Reported robust H1’24 results with H1’24 revenue at €152mn (+43% yoy) and EBITDA settling at €96.9mn (+35%), boosted by the increased installed capacity of 1.22GW (vs 1.08GW in H1’23). The increased profitability filtered through to an adj. net income from continuing operations of €29.9mn (+41% yoy).

National Bank // Press reports are reiterating that the book for HFSF’s placement of a 10% stake in NBG (from its total 18.39% holding), with an option to upsize to 12%, will open on Monday. Demand for the offering is reportedly strong, with the price expected to be set at a small discount. The updated prospectus is scheduled to be submitted over the weekend, at which point the price range will also be determined.

Jumbo // Speaking at yesterday’s EGM, the Chairman echoed once again conservatism for the remainder of the year given the supply chain challenges, although he painted a positive picture for the business in the long-term in Romania and Israel. Asked about shareholder returns, he referred to a combination of dividends and share repurchases, while flagging that if the buyback threshold is reached, the plan is to top up the dividend.

Banks // According to Bank of Greece data, private sector deposits in August increased by €1.40bn m/m, reaching €195.4bn (+3.3% y/y), following an outflow of €0.61bn in July. Furthermore, there was reversal in the flow of credit to the private sector in August, with monthly inflows of €0.1bn, from the €1.14bn outflows observed in July.

* Tα παραπάνω σχόλια μπορείτε να τα διαβάσετε πρώτοι στο viber του mikrometoxos.gr

ΑΠΟΠΟΙΗΣΗ ΕΥΘΥΝΩΝ: Το περιεχόμενο και οι πληροφορίες της στήλης προσφέρονται αποκλειστικά και μόνο για ενημερωτικούς σκοπούς και σε καμία περίπτωση δεν μπορούν να εκληφθούν ως συμβουλή, πρόταση, προσφορά για αγορά ή πώληση των κινητών αξιών, ούτε ως προτροπή για την πραγματοποίηση οποιασδήποτε μορφής επένδυσης. Κατά συνέπεια δεν υφίσταται ουδεμία ευθύνη για τυχόν επενδυτικές και λοιπές αποφάσεις που θα ληφθούν με βάση τις πληροφορίες αυτές.

* Tα παραπάνω σχόλια μπορείτε να τα διαβάσετε πρώτοι στο viber του mikrometoxos.gr

ΑΠΟΠΟΙΗΣΗ ΕΥΘΥΝΩΝ: Το περιεχόμενο και οι πληροφορίες της στήλης προσφέρονται αποκλειστικά και μόνο για ενημερωτικούς σκοπούς και σε καμία περίπτωση δεν μπορούν να εκληφθούν ως συμβουλή, πρόταση, προσφορά για αγορά ή πώληση των κινητών αξιών, ούτε ως προτροπή για την πραγματοποίηση οποιασδήποτε μορφής επένδυσης. Κατά συνέπεια δεν υφίσταται ουδεμία ευθύνη για τυχόν επενδυτικές και λοιπές αποφάσεις που θα ληφθούν με βάση τις πληροφορίες αυτές.

Ακολουθήστε το mikrometoxos.gr στο Google News

και μάθετε πρώτοι όλες τις ειδήσεις