ATHEX headed south yesterday, underperforming the European stock markets. In more detail, the General Index slipped by 0.14% at 1,417.50 units (FTSE Large Cap: -0.44%, FTSE Mid Cap: +0.32%, Banks Index: -1.34%) and the traded value was shaped at EUR 141.2m, down from Wednesday’s EUR 143.7m. We expect ATHEX to try to move higher today.

Macro Headlines

Greek Primary Surplus to exceed targets (press)

According to Kathimerini, Greece is set to record 2.6%-2.7% primary balance, above the 2.1% target in the stability programme and the recent 2.4% target included in the budget for 2025e.

Overall Import Price Index (MPI) decreased in September

According to ELSTAT, the Overall Import Price Index (MPI) in Industry in September 2024 recorded a decrease of 10.6% y-o-y, while in September 2023 the MPI had recorded a y-o-y decrease of 9.2%. The 10.6% y-o-y decrease of the MPI was mainly driven by the 24.1% y-o-y decrease of the Energy products sub-index while the non-durable consumer goods sub-index rose by 0.9% y-o-y. Over the twelve-month October 2023- September 2024 period, the MPI decreased by 4.1% compared to the October 2022- September 2023 period.

Sector Headlines

Government considers the imposition of a cap in the wholesale electricity market (press)

According to Energypress.gr, in the light of the recent spike in wholesale electricity prices, the Ministry of Energy considers imposing a cap in the wholesale electricity market instead of an extra tax on excess profits.

Company Headlines

PPC || Outperform | CP: EUR 12.35 | TP: EUR 17.40

Capital Markets Day Highlights: guides for 2025e EBITDA at EUR 2.0bn and up to EUR 2.7bn by 2027e from EUR 1.8bn in 2024e, RES capacity target to 11.2 GW (including 3.4GW Hydros) by 2027e complete phase out of lignite plants, EUR 9.2bn cumulative investments by 2027e, Net Debt/EBITDA to increase to 3-3.5x by 2026 (from 3x in 2024e), dividend payments to gradually increase from EUR 0.40/share in 2024e to EUR 1/share by 2027e

PPC presented yesterday its new medium-term business plan and financial outlook. Key topics of the presentation are the following:

- Financials: PPC guides for EUR 1.8bn EBITDA in 2024e (EUR 0.7bn from distribution), EUR 2bn in 2025e and EUR 2.7bn in 2027e (above previous target of EUR 2.3bn by 2026e). Adjusted Net profits after minorities are expected to jump from EUR 350m in 2024e to EUR >400m in 2025e and EUR >800m by 2027e, driven by lignite phase out, RES additions and distribution (2023-27e EPS CAGR at +35%).

- Dividends: dividend payments expected to increase from EUR 0.25/share in 2023, to EUR 0.40/share in 2024e, EUR 0.60/share in 2025e and up to EUR 1/share by 2027e (DPS CAGR: +41.4% over 2023-27e).

- CapEx requirements are set to peak in 2025-26e to EUR 3.7bn, driven by RES (51% of total) and followed by distribution (27%). PPC guides for cumulative capex of EUR 9.2bn in 2025-27e, which will be mainly funded by operating cash flows (EUR 7bn) and additional debt (EUR 3bn).

- Leverage: the company guides for Net Debt of 3.0x Net Debt/EBITDA in 2024e and to 3.0-3.5x in 2027e (unchanged vs. previously).

- Greener business model: accelerated phase-out of existing lignite plants by 2026e, including Ptolemaida V, and scale-up of RES capacity.

- Regarding RES, the company is targeting to accelerate the installation of its capacity by 2027e with the addition of 6.3GW by 2027e, mainly solar (previous target 4.4GW additions by 2026e), 3.8GW are already under construction or ready to build, 3.3GW of which in Greece, and 3GW abroad. PPC holds a total RES licensed portfolio of 22.5GW, 5.3GW of which is considered mature.

Comment: PPC presented an ambitious business plan, which will complete the transformation (which begun back in 2019) from a national electricity utility, to a regional integrated energy player in the SE Europe. We consider the abovementioned RES targets by 2027e as feasible, since a) the 2/3 of the medium-term capacity target is already under construction or ready to build, b) solar panel prices are normalizing after their peak in 2023e and c), PPC’s current leverage (c. 2.7x Net Debt/EBITDA in 9M24) offers room for additional debt raising. On top of the future growth, PPC is set to relaunch its dividend pay-out policy, offering significant dividend yields in the medium term: EUR 0.40 DPS in 2024e implies a 3.3% DY and the EUR 1.0/share by 2027e DY at 8.1%.

HELLENiQ ENERGY || Under Review | Target Price U/R | CP: EUR 6.88

3Q24 results Review: Results beat performance at adjusted level; declared an interim DPS of EUR 0.20

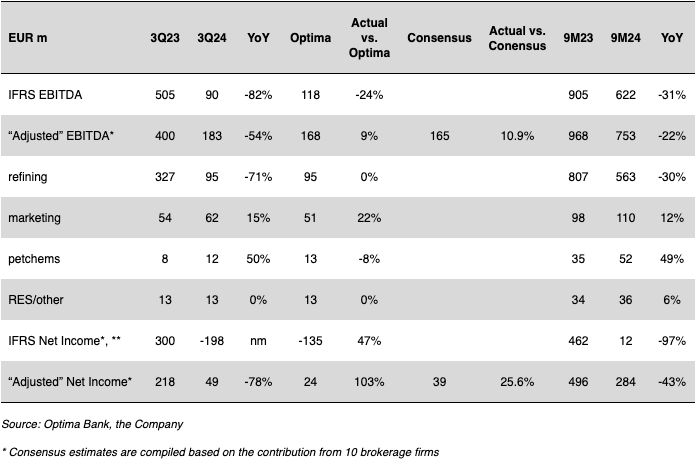

Facts: HELLENiQ ENERGY reported 3Q24 “adjusted” group EBITDA down by 54% YoY to EUR 183m on weak refining environment (beating consensus and our estimate), while “adjusted” net income shaped at EUR 49m from “adjusted” net profits of EUR 218m in 3Q23, also above our call and consensus. Accounting for inventory and one-off losses of EUR 93m in 3Q24 vs. inventory and one-off gains of EUR 105m in 3Q23, HELLENiQ ENERGY reported IFRS EBITDA of EUR 90m, down by 82% YoY and IFRS net losses of EUR 198m (including the EUR 173m solidarity tax) compared to net profits of EUR 300 in 3Q23. It is noted that adjusted figures exclude any impact from the solidarity tax, which HE expects to be paid in February 2025.

3Q/9M24e Group Key P&L Results

Domestic refining and trading division: HELLENiQ ENERGY’s realized blended margin (incl. propylene contribution which is reported under Petchems) in 3Q24 corrected to USD 10.9/bbl from USD 13.2/bbl in 2Q24 and USD 20.5/bbl in 3Q23, well outperforming the USD 3.6/bbl benchmark margin, mainly on wider cracks. The refinery utilization rate in 3Q24 was 110% vs. 105% a year ago. Sales volume was consequently up by 8% YoY to 4.16m tons, driven by an 9.6% YoY rise in exports sales to 1,927 tons. All in, 3Q24 “adjusted” EBITDA stood at EUR 95m (vs. EUR 327 a year ago).

Marketing: Domestic demand in 3Q24 rose by 2% YoY driven by higher by 4% Diesel and 3% Gasoline demand. Jet fuel demand was also up by 10% YoY, while bunkering demand was up by 6% YoY. Consequently, domestic EBITDA jumped to EUR 38m (from EUR 27m last year), while international marketing EBITDA was up by 13% YoY to EUR 26m, also aided by the network expansion by 6 petrol stations.

Petrochemicals: Stronger y-o-y PP margins led to increased petchems contribution, with Adj. EBITDA up by 50% YoY at EUR 12m in 3Q24.

Power & gas (equity consolidation): Elpedison’s EBITDA contribution in 3Q24 was positive at EUR 8m from EUR 4m loss in 3Q23 as weather conditions, electricity demand and gas-fired plants flexibility supported increased participation in the energy mix.

RES: segmental profitability in 3Q24 shaped at EUR 13 (unchanged y-o-y), with the installed capacity reaching 384MW by 3Q24-end (from 356MW a year ago).

FCF & Net debt: FCF in 9M24 was weaker y-o-y at EUR 277m from FCF of EUR 820m in 9M23 on lower operating profitability and increased by EUR 64m investing outflows of EUR 220m. After paying EUR 233m for dividends and EUR 91m for interest expenses, group net debt (excluding leasing liabilities) rose marginally by 210m y-t-d in 9M24 to EUR 1.77bn.

Conference call comments: a) FID for test drilling within the next couple of quarters, b) outlook for remainder of 2024 positive, as margins improve after the tumble in August-September, c) RES capacity currently at 384MW, 700MW under development, additional 124MW in operation by year end, expects to operate 1GW by 2026 and 2GW by 2030e, some delays are observed in receiving connection terms, d) ELPEDISON resolution with EDISON in the next weeks, DEPA developments in the next few months e) extra tax of EUR 173m to be paid in February 2025.

OTE || NEUTRAL | CP: EUR 14.77 | TP: EUR 15.00

3Q2024 Review | Results broadly in line with our estimates, Mgt revised downwards 2024 FCF guidance due to the ad hoc tax payment in Romania

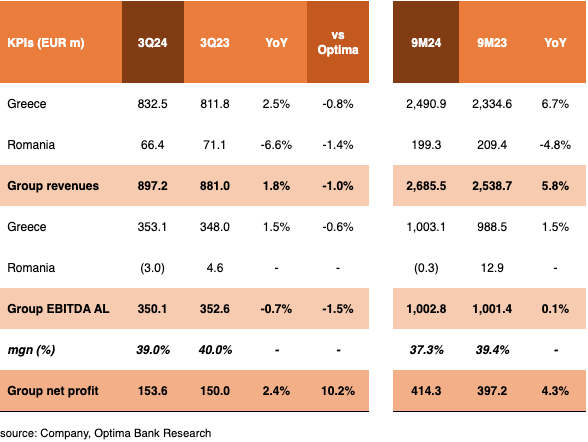

Optima View: OTE delivered a mixed set of results that came broadly in line with our call in EBITDA and beat our estimate on higher than expected investment gains. Performance in Greece was in line with our estimates but in Romania remained was once more weaker than expected. Following the release of 3Q results, we’ll update our estimates, rating and TP.

Guidance 2024: Management revised downwards 2024 Free Cash Flow (FCF) guidance to EUR 435m from EUR 470m previously, due to the extraordinary ad hoc tax payment of EUR 33.5m in Romania and also reiterated that it expects CapEx in the range of EUR 610m-620m. Finally, it anticipates 4Q EBITDA trend in Greece to be consistent with the first nine months of the year.

Upcoming Catalysts: The deployment of the the Gigabit Voucher should promote additional take-up of FTTH services, the sports content-sharing agreement with NOVA is accelerating takeup of Pay-TV services and the volume discount agreement in the FTTH wholesale market should further promote transition towards fiber optic services and enhance the monetization of the l investment.

3Q24 Group Results: Revenues came in at EUR 897.2m (+1.8% y-o-y), slightly below Optima estimate of EUR 906.6m. Adjusted EBITDA AL reached EUR 350.1m (-0.7% y-o-y), broadly in line with Optima estimate of EUR 355.4m, with the respective margin at 39.0% from 40.0% in 3Q23. Net profit was shaped at EUR 153.6m (+2.4% y-o-y), 10% above Optima estimate of EUR 139.4m on higher than expected gains from investments and other financial assets.

Greece: 3Q24 top line rose by 2.5% y-o-y to EUR 832.5, driven by mobile service revenues (+2.9% y-o-y) and other revenues/ICT, handset (+12.4% y-o-y), whilst retail fixed services were flattish (-0.3% y-o-y), as broadband subscribers rose by 0.3% y-o-y since FTTH subscribers skyrocketed by 64.6% y-o-y to 355,054, TV subscribers rose by 6.9% y-o-y to 710,189, while mobile subscribers decreased by 1.8% y-o-y to 7,184,707. The migration from prepaid to postpaid continued unabated with postpaid subscribers up by 7.0% y-o-y and prepaid subscribers down by 6.8% y-o-y. Adj. EBITDA AL was shaped at EUR 353.1m (+1.5% y-o-y), in line with our call of EUR 355.1m and the respective margin at 42.4% vs. 42.9% in 3Q23.

Romania: 3Q24 revenues slipped by 6.6% y-o-y to EUR 66.4m, impacted were impacted by continuing challenging market dynamics and the mobile termination rate cuts. Mobile subscribers slipped by 9.0% y-o-y to 3,547,121. Adj. EBITDA AL was negative at EUR -3.0m, well below our estimate of EUR 0.3m. In October 2024, the Romanian Tax Authority imposed additional tax charges of €33.5mn on Telekom

Romania Mobile in the context of a tax audit for fiscal years 2017 to 2021. This amount is included in Q3’24 reporting figures but does not impact Adjusted EBITDA (AL) or Adjusted Profit for the period.

Cash Flow/Net Debt: 3Q24 Free Cash Flow (AL) accelerated to EUR 95.2m from EUR 27.0m in 3Q23 on lower CapEx due to lower spending on TV sports content. FCF AL also stood at EUR 343.5m (-13.5% y-o-y) in 9M24. Net debt increased by EUR 227.3m q-o-q to EUR 684.3m, with net debt/Ad. EBITDA AL at just 0.5x. The Group does not face any bond maturity until September 2026.

9M24 Results: Group revenues came in at EUR ca2.69bn (+5.8% y-o-y). Group adj. EBITDA AL was shaped at EUR 1.0bn (+01% y-o-y) and the respective margin narrowed to 37.3% from 39.4% in 9M24. Net profit reached EUR 414.3m (+4.3% y-o-y).

AEGEAN AIRLINES || BUY | CP EUR 9.85 | TP EUR 14.70

3Q/9M24 Results: Grounded fleet and Middle East tension weighted on growth.

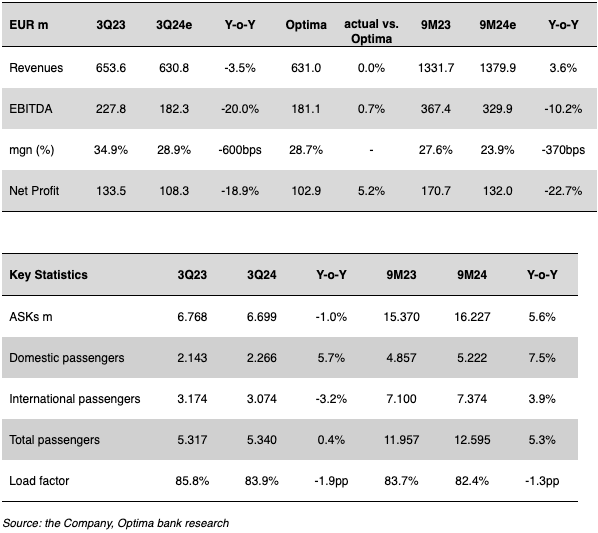

Aegean Airlines released its 3Q24 results, with group revenue down by 3.5% y-o-y to EUR 630.8m (in line with our estimates) vs. EUR 653.8m in 3Q23, mainly affected by reduced charter services due to grounded Neo fleet and the reduced flight activity to/from the Middle East. Group EBITDA decreased by 20.0% y-o-y to EUR 182.3m (in line with our call of EUR 181.1) affected by increased operating costs (aircraft maintenance cost up by 21% y-o-y, lease expenses up by 356% y-o-y and employ benefits also up by 15% y-o-y), while net profit came at EUR 108.3m (above our estimate of EUR 102.9m) and down by -18.9% y-o-y, vs. EUR 133.5m in 3Q23. In 9M24 terms, revenues reached EUR 1379.9m, recording an increase of 3.6% y-o-y, vs. EUR 1331.7m in 9M23, a new all-time high for the company. On the other hand, EBITDA of the group decreased by 10.2% y-o-y, to EUR 329.9m vs. EUR 367.4m in 9M23, while net profit reduced by 22.7% y-o-y and reached EUR 132.0m in 9M24 vs. EUR 170.7m a year ago, impacted by higher depreciation cost but supported by FX gains vs. losses last year. Passenger traffic in 3Q24 shaped at 5.3m (+0.4% y-o-y), while the load factor came in at 83.9% (vs. 85.8% as of 2Q23). In 9M24 terms, passenger traffic increased by 5.3% to 12.6m passengers vs.11.9m passengers in 9M23. Cash & cash equivalents of the group remained robust at EUR 762.8m in 9M24 up from EUR 706.3m in FY23. Net debt including leases, stood at EUR 514.9m vs. EUR 415.3m in FY23 (up by 23.9%), with net debt/EBITDA ratio at 1.4x vs. 1.0x in FY23. Management highlighted that the scheduled mandatory engine inspections of the A320 neo fleet have a significant impact on the company’s cost structure in terms of aircraft maintenance and increased aircraft lease needs, while the tension in the Middle East reduced flight activity and international passenger traffic. The compensation agreed with Pratt & Whitney will cover a significant portion of the burden, but it does not fully offset the cost impact and the loss of the reduced capacity in available seats. For the 4Q24e management stated that Aegean Airlines will offer 7% more seats than the same period in 4Q23 with increased frequencies to/from London, Istanbul, Larnaca, Venice, Berlin, Dubai, Naples, Tirana, Belgrade and Sofia while new flights will be added to Abu Dhabi from Athens and Amsterdam from Thessaloniki.

3Q/9M24 Group Key P&L Results

Aegean Airlines announced new codeshare partnership

The company announced new codeshare partnership with Eurowings Discover with the aim to further enhance connectivity from Germany to expanded network of Greek destinations and mainly to Greek Islands.

Cyprus Popular Bank to dispose its stake in Bank of Cyprus-Press

Reportedly (mononews), Cyprus Popular Bank has started the process of disposing its 4.86% stake corresponding to 21.5m shares through a private placement.

Austriacard Holdings 3Q/9M24 results out

The company posted its results with revenues came in at EUR 298.3m up by 14% y-o-y vs. EUR 261.5m in 9M23 recording strong growth in all segments. Gross profit of the group increased by 18.3% y-o-y to EUR 137.5m vs. EUR 116.2m in 9M23 with gross margin at 46.1% (vs. 44.4% in the corresponding period). On the profitability front, adj. EBITDA reached EUR 43.1m, up by 18.1% y-o-y vs. EUR 36.5m in 9M23, while Net profit reached EUR 16.8m vs. EUR 14.5m in 9M23 up by 15.7% y-o-y.

Petropoulos 9M24 results out

The company posted its results with revenues recording an increase of 13.2% y-o-y to EUR 168.1m vs. EUR 148.6m in 9M23. EBITDA of the group reached EUR 13.1m vs. EUR 12.3m in 9M23 or up by 6.5%, while net Profit reached EUR 6.0m vs. EUR 6.6m in 9M23, recording a y-o-y decrease of -9.8% negatively affected by higher finance costs and depreciation expenses. Finally cash and cash equivalents of the group reduced to EUR 11.8m vs. EUR 12.5m in FY23.

Market Comment // The ASE Index declined for a second day on Thursday, edging -0.14% lower as banks continued in correction mode (-1.34%). Trading activity remained >€140m, of which banks represented c57%. Piraeus (-2.34%) led financials lower, with NBG losing 1.75% and Eurobank down -1.42%, while Alpha managed to eke out small gains (+0.12%) at the end of the session. OTE (-3.02%) was the leading non financials laggard, trailed by losses in EYATH (-2.76%) and Thrace (-1.13%), and a milder drop in Jumbo, Lamda, Kri Kri, Profile, Dimand and Fourlis. On the other hand, Titan stood out among gainers rallying +3.68%, followed by Intralot, AIA, MOH, ADMIE, Optima bank, Viohalco and Cenergy (all up >1%). EU futures are pointing to another negative opening today, as investors are mulling the monetary policy path after the somewhat hawkish rhetoric by the Fed Chairman yesterday.

PPC // hosted a conference call to update on the Strategic Plan for 2025-2027. The strategy builds on the pillars established in January’s CMD, with management now guiding for €2.7bn EBITDA in FY’27e, 25% higher than our estimate. The investment case is underpinned by a compelling dividend yield (progressively up to €1.0/share, or 8% at the current price level) and reasonable leverage guidance (with management reiterating the 3.5x Net Debt/EBITDA ceiling).

HelleniQ Energy // Q3’24 results exceeded both our estimates and market consensus, with adjusted EBITDA at €183mn (-54% yoy; +9% vs. consensus), mainly due to a stronger-than-expected performance in the Fuels Marketing segment. At the bottom line, HelleniQ reported a net quarterly loss of €198mn, including a solidarity tax contribution of €173mn from last year’s results. The Group also announced an interim dividend of €0.20/share, with an ex-dividend date of 20 January 2025 (2.9% yield).

Energy // As per Kathimerini, the Greek govt plans to reinstate the price cap on wholesale energy prices to protect consumers from resurgence in retail costs. The Energy Minister will seek EU support but is ready to act independently if needed. This initiative includes a revenue cap in the wholesale market to fund subsidies for households and businesses.

OTE // OTE reported relatively tepid results in line with expectations, with underlying adj. EBITDAaL (excl. VES and Romania-related charges) +0.4% yoy in Q3 (and +0.5% in the 9M, compared to >3% delivered on average by EU telcos). Retail fixed trends stayed flattish, while mobile remained robust (+2.9%), bringing Greece’s EBITDA to €353m, +1.5% yoy. Cash generation was healthy in the quarter (adj. FCF >€100m). At the call, mgt sought to echo a positive message regarding scope for ARPU accretion in fixed (Pay TV and fiber penetration) for 2025 and the chances of the Romania sale being wrapped up this time.

Bank of Cyprus // According to Bloomberg, Cyprus Popular Bank is considering selling c21.5mn existing ordinary shares of Bank of Cyprus Holdings, representing about 4.9% of the company’s outstanding shares. If this sale was to proceed, Cyprus Popular Bank would no longer hold any stake in Bank of Cyprus.

Aegean Airlines // Aegean reported Q3’24 results in broad sync with our forecasts, with EBITDA down 20% yoy (€182m) on sales of €631m (-3% yoy). As such, 9M’24 revenues rose 4% to a record €1.38bn, EBITDA dropped 10% to €330m and net profit was down 23% to €131m. We note that consensus FY’24e EBITDA (€385m) implies Q4’24e EBITDA of c€55m (vs €33m in Q4’23), which looks feasible.

Austriacard // Strong Q3 results, with revenues +30% yoy and adjusted EBITDA +35% yoy to €14.3m. This brings 9m sales at €298m (+14%) and adj. EBITDA at €43m (+18%), reaffirming mgt’s expectation for backloaded growth in 2024 given the comparative. Net profit post minorities in the 9M settled at €16.2m vs €14.2m in the same period last year. Of note is that operating cash flow also improved markedly, resulting in just a €9m increase in ACAG’s net debt position in the 9 months vs the Dec’23 position.

Lamda // In a confident conference call yesterday Lamda management highlighted the significant progress in the Ellinikon development, with cash proceeds of €967m already exceeding the targeted FY’24 figure (€900m), and its ability to fund the early works and residential constructions through own funds. We reiterate our structural positive view on the group, with Lamda mgt efficiently navigating through the Ellinikon development and growing its operational assets.

Alpha Trust Andromeda // New shares (18,981) issued following the dividend re-investment plan. The outstanding share capital amounts to 3.65m shares as of today.

* Tα παραπάνω σχόλια μπορείτε να τα διαβάσετε πρώτοι στο viber του mikrometoxos.gr

ΑΠΟΠΟΙΗΣΗ ΕΥΘΥΝΩΝ: Το περιεχόμενο και οι πληροφορίες της στήλης προσφέρονται αποκλειστικά και μόνο για ενημερωτικούς σκοπούς και σε καμία περίπτωση δεν μπορούν να εκληφθούν ως συμβουλή, πρόταση, προσφορά για αγορά ή πώληση των κινητών αξιών, ούτε ως προτροπή για την πραγματοποίηση οποιασδήποτε μορφής επένδυσης. Κατά συνέπεια δεν υφίσταται ουδεμία ευθύνη για τυχόν επενδυτικές και λοιπές αποφάσεις που θα ληφθούν με βάση τις πληροφορίες αυτές.

* Tα παραπάνω σχόλια μπορείτε να τα διαβάσετε πρώτοι στο viber του mikrometoxos.gr

ΑΠΟΠΟΙΗΣΗ ΕΥΘΥΝΩΝ: Το περιεχόμενο και οι πληροφορίες της στήλης προσφέρονται αποκλειστικά και μόνο για ενημερωτικούς σκοπούς και σε καμία περίπτωση δεν μπορούν να εκληφθούν ως συμβουλή, πρόταση, προσφορά για αγορά ή πώληση των κινητών αξιών, ούτε ως προτροπή για την πραγματοποίηση οποιασδήποτε μορφής επένδυσης. Κατά συνέπεια δεν υφίσταται ουδεμία ευθύνη για τυχόν επενδυτικές και λοιπές αποφάσεις που θα ληφθούν με βάση τις πληροφορίες αυτές.

Ακολουθήστε το mikrometoxos.gr στο Google News

και μάθετε πρώτοι όλες τις ειδήσεις